per capita tax in pa

Other taxes include value-added and real estate taxes. Municipal Per Capita Tax PDF Occupation Tax PDF Newville Borough.

Real Estate And Per Capita Tax Wilson School District Berks County Pa

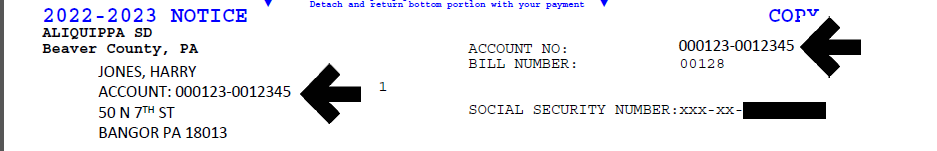

Per Capita Tax Occupation Tax Real Estate Tax or Utility Bill HAB-MISC Learn more and make a payment.

. For all the hundreds and really thousands of years before 1820 the average GDP per capita was even lower. Taxpayer Annual Local Earned Income Tax Return. Per Capita Tax Township and Whitehall-Coplay School District.

As the IFOs report notes personal income tax revenues increased by almost 14 million to 9729 million in July a 14 increase. There are also jurisdictions that collect local income taxesPennsylvania has a 999 percent corporate income tax rate and permits local gross receipts taxesPennsylvania has a 600. This list of municipalities may change at any time.

This article is a list of the countries of the world by gross domestic product GDP at purchasing power parity PPP per capita ie the PPP value of all final goods and services produced within a country in a given year. Delinquent Per Capita Tax and MercantileBusiness Privilege Tax for some of its members. See GDP-per-capita tax haven proxy for more detail.

Delinquent per capita tax cannot be accepted at the Tax Claim bureau office. International Monetary Fund 2017 World Bank 2016 Rank. Please complete the form below if you are a.

For instance the Irish GDP data above is subject to material distortion by the tax planning activities of foreign multinationals in Ireland. Download the BerkApp Submit Documents ONLY. In 1820 the global GDP per capita is estimated to have been around 1102 international- per year and this is already after some world regions had achieved some economic growth.

This Is the City With the Most Gun Stores in Pennsylvania. The Earned Income and Local Service taxes are collected by Berkheimer Tax Administrator 50 N. They may be reached toll free at 800-328-0565.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. The tax is paid 47 to Hempfield Township and 5 to the Hempfield Area School District. Per Capita tax is a flat tax of 15 per person over the age of eighteen 18.

Act 32 is effective in Pennsylvania as of January 1 2012. Quarterly Estimated Tax Return. If you do not receive the bills in the mail by Mid March please contact the Moore Township Tax Collector at 484-294-3798 or email at.

Pennsylvania Reports Higher Gun Sales per. Lehigh Valley PA 18002. Many of the leading GDP-per-capita nominal jurisdictions are tax havens whose economic data is artificially inflated by tax-driven corporate accounting entries.

The 2022 Moore Township Real Estate and Per Capita bills have been mailed. They can be accepted at Berkheimer Statewide Recovery and the Treasurers Office. Mortality in the most affected countries.

Pennsylvania has a flat 307 percent individual income tax. Refer to the Tax RateMillage Rate Sheet under Related Documents for specific discount andor penalty rates. The March Bill.

Sales and use taxes followed suit going up 207 million to 126 billion in July a 16 increase. 2491 COMMUNITY DR BATH PA 18014 on Wednesdays from March 2 to April 27 from 930am to 1pm Friday April 29 from 930am to 3pm. Printable PDF Pennsylvania Sales Tax Datasheet Pennsylvania has a statewide sales tax rate of 6 which has been in place since 1953.

PA Sales Tax Calculator. Ranked 29th highest by per capita revenue from the statewide sales tax 724 per capita PA City County Taxes. To address this in 2017 the Central Bank of Ireland created modified GNI or GNI as.

For the twenty countries currently most affected by COVID-19 worldwide the bars in the chart below show the number of deaths either per 100 confirmed cases observed case-fatality ratio or per 100000 population this represents a countrys general population with both confirmed cases and healthy people. How does Pennsylvanias tax code compare. You will receive at this time a Personal Tax Notice if levied which will include the following.

Keystone is the tax collector on behalf of the Township. We would like to show you a description here but the site wont allow us. York County Tax Claim Bureau 28 E Market St York PA 17401 Phone.

Delinquent Tax Per Capita Tax Real Estate Tax Utility. The top individual income tax rate is 45 percent and the top corporate tax rate is 25 percent. Taxes in Pennsylvania Pennsylvania Tax Rates Collections and Burdens.

The Tax Foundation is the nations leading independent tax policy nonprofit. ANYONE HAVING OVERDUE TAXES. Learn more about Act 32 from the PA Department of Community.

The overall tax burden equals 152 percent of. Welcome to the Tax Claim Bureau.

How Much Income You Need To Afford The Average Home In Every State The Housing Market Has Not Only Infographs Housing Investi Map Usa Map 30 Year Mortgage

Per Capita Tax Exemption Form Keystone Collections Group

Tax Burden By State 2022 State And Local Taxes Tax Foundation

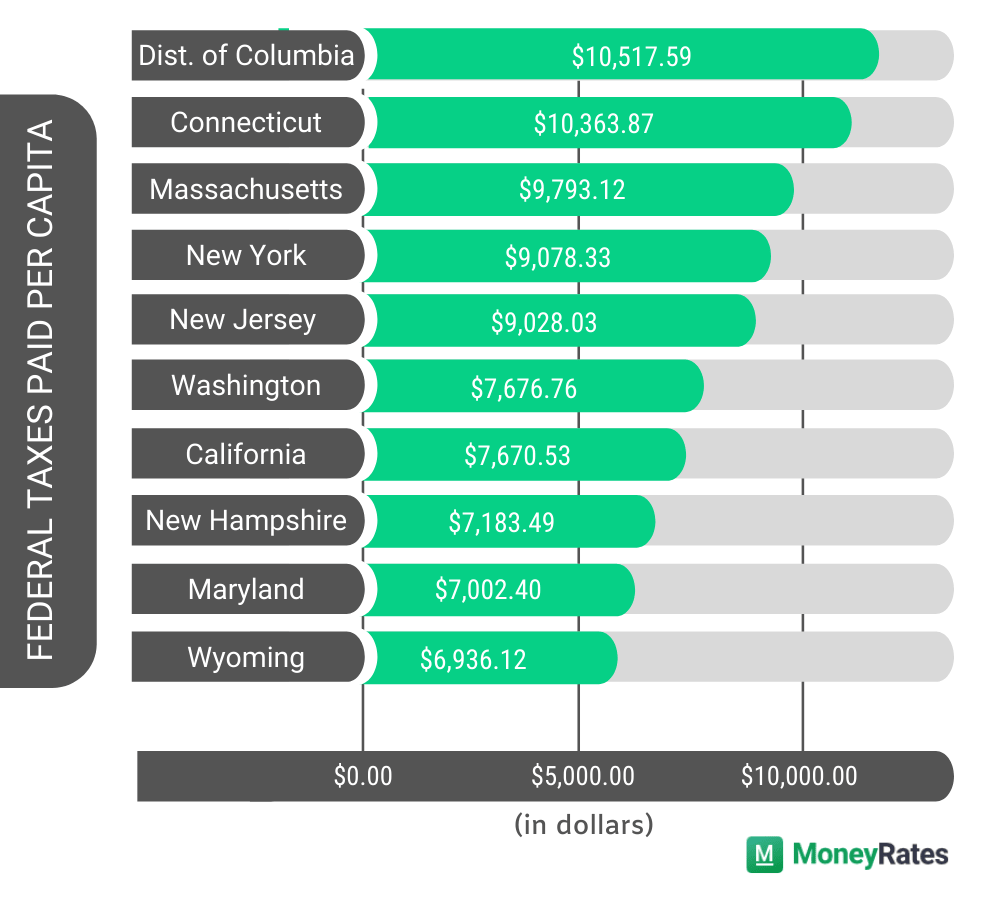

Which States Pay The Most Federal Taxes Moneyrates

Information About Per Capita Taxes York Adams Tax Bureau

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Bosnia And Herzegovina Gdp Per Capita Economic Indicators Ceic

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

Comments

Post a Comment